Optimize your payments and take control of the business funds. Send funds to anyone, anytime.

- Conduct a number of payments 24/7 via Business Online Banking

- Payroll, pension, expense reimbursements and dividends

- Payments to vendors

- Pay state and federal taxes and more

- Same Day ACH allows you to complete payments on your terms including the same day the ACH is originated

- Schedule one-time or recurring outgoing payments

- Eliminate manual check preparations and reduce costs associated with issuing and reconciling

- Reduce fraud losses related to stolen checks, counterfeit checking, altered and forged checks

- Efficient and accurate processing, providing more visibility to your cash position

- Improve cash flow

- Increase productivity by automating processes

Making International Business Payments?

You’ll receive near real-time exchange rate quotes prior to submitting a payment order. This gives you full transparency and control over your cash flow. The funds are exchanged into the recipient’s local currency and the transfer can take as little as two days.

Benefits

- Send money by wire transfer, direct credit or draft in a total of over 130 currencies

- Depending on your size, we offer a user-friendly online platform that can allow you to send payments in minutes

- Near real-time exchange rate quotes

- No surprise fees

- We can track your payments

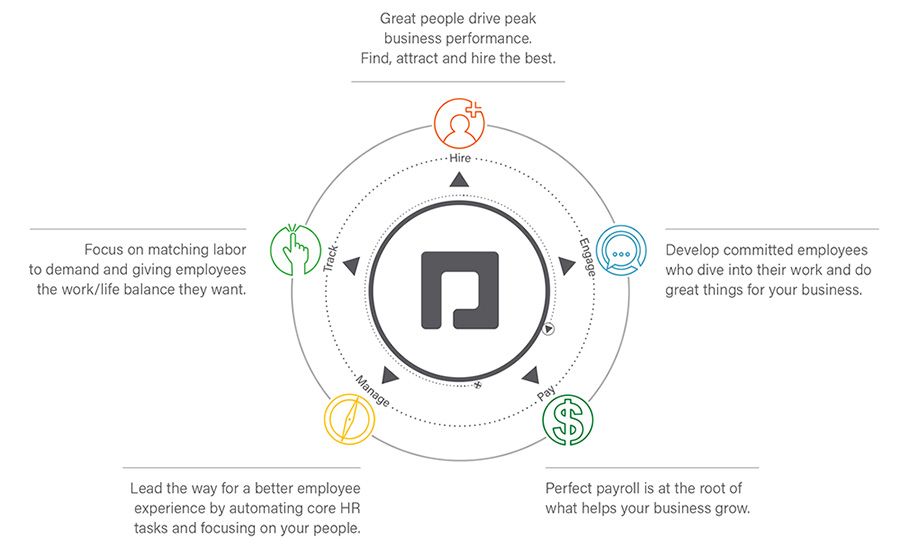

With our partner Paycom®, Peoples National Bank is able to offer options for your business. Discover a complete solution for payroll and other human resource tasks. These options help save you time and effort so you can focus on your business. You are able to manage the entire employee experience from one application.

Contact us to see how Paycom® can help your business.

Benefits for Employers

- Saves businesses money by eliminating need for paper payroll checks, postage, and reconciliation

- Reduces businesses’ need to store large quantities of cash

- Streamlines payment processes by auto-loading employees’ payroll cards

- Simplifies the account reconciliation process by reducing the number of payroll debits

Benefits for Employees

- Simplifies the withdrawal process – employees can withdraw from any ATM

- Freedom to use the card at any establishment that accepts Visa®

- Support available 24/7 through a toll-free phone service for lost/stolen cards

- Convenience of not having employees searching where to cash their payroll checks

Commercial Rewards

Make your payments work harder and smarter with the Commercial Rewards Card. Developed exclusively for businesses with up to $150 million in annual revenue, this commercial card program combines card, expense and travel management into a single platform. It replaces cumbersome, manual processes with a single, user-friendly platform. A no charge rewards program; standard TravelBank fees apply for the upgraded travel option.

- Simple accounting integrations: straightforward integrations with common accounting tools like QuickBooks Online, Xero, NetSuite and others let you close your books faster.

- Earn rebate: increase your rebate potential with lower spend thresholds than traditional commercial cards – and no annual fee.

- Integrated policies: customize card controls and integrated expense and travel policies to meet your business needs.

- Liability at the corporate level: enjoy increased spending power with no personal guarantee.

One Card

The One Card combines benefits of travel and purchasing cards into one card program. It’s an expense management solution that allows your clients to pay for everything with a single card — from airfare, to fuel, to supplies.

The card's customizable spending functionality is designed to meet each employee's requirements and manage all of your spending. Your organization can create multiple user profiles to fit each cardholder's needs, such as frequent business travelers and purchasing managers. One Card is a non-revolving, non-interest bearing charge card, typically with an annual spend greater than $250,000.

In addition to comprehensive card program management, reporting and virtual payment capabilities, it also supports cash management strategies, risk management and advanced systems integration. Key system features include:

- Online Access 24/7: US based support team that provides easy access to manage transactions, statements, cardholder profiles and cardholder account features.

- Transaction Management: view transactions for up to the last 6 billing cycles and add client specific details to transactions, such as purchase receipts, tax information and route for approval; download statements for the last 18 months.

- Payment Plus: extends commercial card payments to higher value transactions typically paid by check; provides Accounts Payable (A/P) with the flexibility, float and rebate of a commercial card, along with control and security of a "virtual" card account.

- Reporting & Statements: choose from a variety of standard and ad-hoc reports dashboard reporting, which provides summary performance "snapshots" and report scheduler for standard and ad hoc reports.

- Financial Extracts: select from standard, general ledger and payment data extracts to integrate into your organizations existing financial systems.

Virtual Pay

Complement your program with the convenience of virtual card account capabilities delivered by Virtual Pay.

- Reduce fraud and gain greater control by establishing set credit limit and validity periods.

- Gain processing savings when you eliminate costly manual, paper-based processes.

- Leverage improved data, reporting and reconciliation to support vendor negotiations and simplify reconciliation.

- Improve revenue streams by increasing your rebate opportunity and extend your float.

Contact us to see which is right for your organization!

- Quick and secure same day movement of funds

- Direct connectivity with the Federal Reserve for domestic wires

- Initiate domestic and international (USD/FX) wire transfers within Business Online Banking, visiting a branch or electronically

- Schedule one-time transfers or create recurring templates for future use in Business Online Banking

- Only authorized individuals are able to initiate wires

- Multiple layers of security are utilized

- Dollar limit

- Passwords, tokens and alerts

- Personal Identification Numbers (PINs) and call recording

- Confirmation available for incoming and outgoing transactions

Real Time Payments (RTP) and FedNow

- Real-Time: Say goodbye to waiting days for payments to clear. With RTP and FedNow, transactions are processed instantly, allowing you to access your funds immediately.

- 24/7/365 Access: RTP and FedNow operates around the clock, ensuring that you can send and receive payments whenever you need to, even on weekends and holidays.

- Security and Fraud Protection: Rest assured that your payments are processed securely and efficiently. RTP and FedNow utilizes advanced encryption and authentication technologies to protect your transactions against fraud and unauthorized access.

- Seamless Integration: RTP and FedNow seamlessly integrates with our existing banking infrastructure, making it easy for you to incorporate instant payments into your everyday banking activities.